23andMe to merge with Virgin Group’s VG Acquisition Corp.

23andMe, a leading consumer genetics and research company, and VG Acquisition Corp., a special purpose acquisition company sponsored by Virgin Group have entered into a definitive merger agreement. Upon completion of the transaction, estimated in the second calendar quarter of 2021, VGAC will change its New York Stock Exchange (NYSE) ticker symbol, and the combined company’s securities will trade under the ticker symbol “ME”.

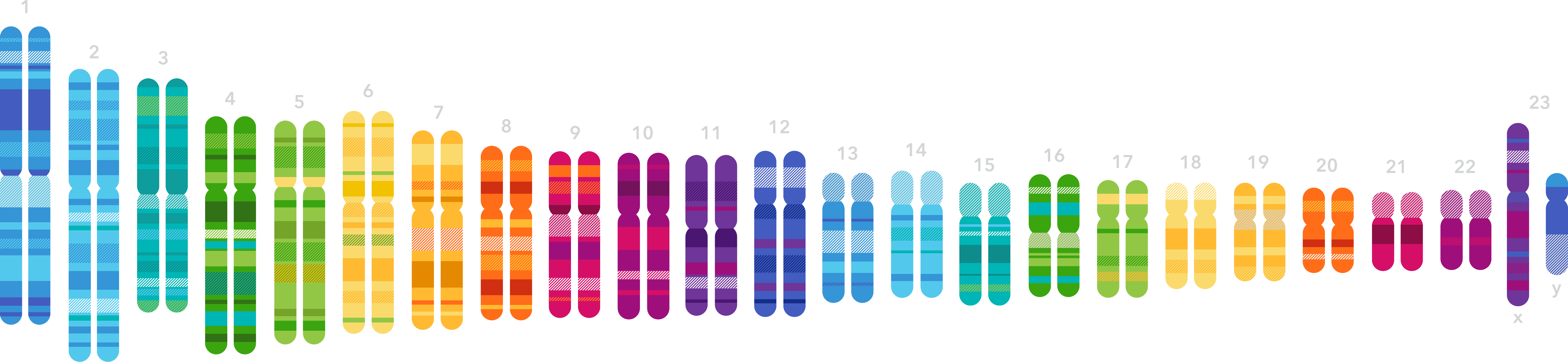

23andMe offers a personalised health and wellness experience and has built a premier genetic database to unlock insights including potential therapeutic treatments for disease. The transaction will provide the capital to fund additional investment in key growth initiatives across 23andMe’s consumer health and therapeutics businesses.

The transaction will value the outstanding shares of capital stock of 23andMe at an aggregate enterprise value of approximately $3.5 billion. 23andMe CEO and Co-Founder Anne Wojcicki and Virgin Group’s Richard Branson are each investing $25 million into the $250 million PIPE and are joined by leading institutional investors including Fidelity Management & Research Company LLC, Altimeter Capital, Casdin Capital and Foresite Capital. The pro forma cash balance of the combined company will exceed $900 million at closing. Current shareholders of 23andMe will own 81% of the combined company.

“As a fellow industry disruptor as well as early investor in 23andMe, we are thrilled to partner with Sir Richard Branson and VG Acquisition Corp. as we approach the next phase of our business, which will create new opportunities to revolutionise personalised healthcare and medicine,” said Anne Wojcicki, CEO and Co-Founder of 23andMe. “We have always believed that healthcare needs to be driven by the consumer, and we have a huge opportunity to help personalise the entire experience at scale, allowing individuals to be more proactive about their health and wellness. Through a genetics-based approach, we fundamentally believe we can transform the continuum of healthcare.”

“Of the hundreds of companies we reviewed for our SPAC, 23andMe stands head and shoulders above the rest," said Richard Branson, Virgin Group Founder. “As an early investor, I have seen 23andMe develop into a company with enormous growth potential. Driven by Anne’s vision to empower consumers, and with our support, I’m excited to see 23andMe make a positive difference to many more people’s lives.”

Go to VG Acquisition Corp.’s website to find out more, read the full press release, watch the investor presentation webcast and download the investor presentation deck.