Buy now, pay better with Virgin Money Slyce

Information correct as of 26 July 2022. Please check latest terms before applying.

Virgin Money has announced it is set to enter the buy now, pay later market later this year, with Virgin Money Slyce.

As well as enjoying the benefits of a traditional buy now, pay later offer, customers will be able to: build their credit score while using Slyce, spend in any currency without worrying about foreign exchange fees or extra charges, and even earn cashback when shopping at select retailers – including H&M, Sweaty Betty, Space NK and more.

Virgin Money Slyce will give customers the flexibility to buy now and pay better, with all their spending in one hassle-free monthly payment – making it easier to manage their money. Any monthly spend over £30 can be spread across three-, six-, nine- or 12-month repayment plans to suit individual needs – and there’s no fee if it’s paid back in three or six months. For longer plans there is an instalment fee – for nine monthly payments customers will have a 7.5% fee added, and for 12 monthly payments a 10% payment fee will be added.

Hugh Chater, chief commercial officer at Virgin Money, said: “It’s clear that consumers now expect to be able to pay via buy now pay later plans, so we’re very excited to offer an option that will bring more customers into a regulated credit environment at the same time as offering market-leading terms, flexibility and simplicity. Importantly, Slyce will help our customers stay in control of their spending while also building their credit score for the future – allowing our customers to buy now, pay better on terms that work for them.”

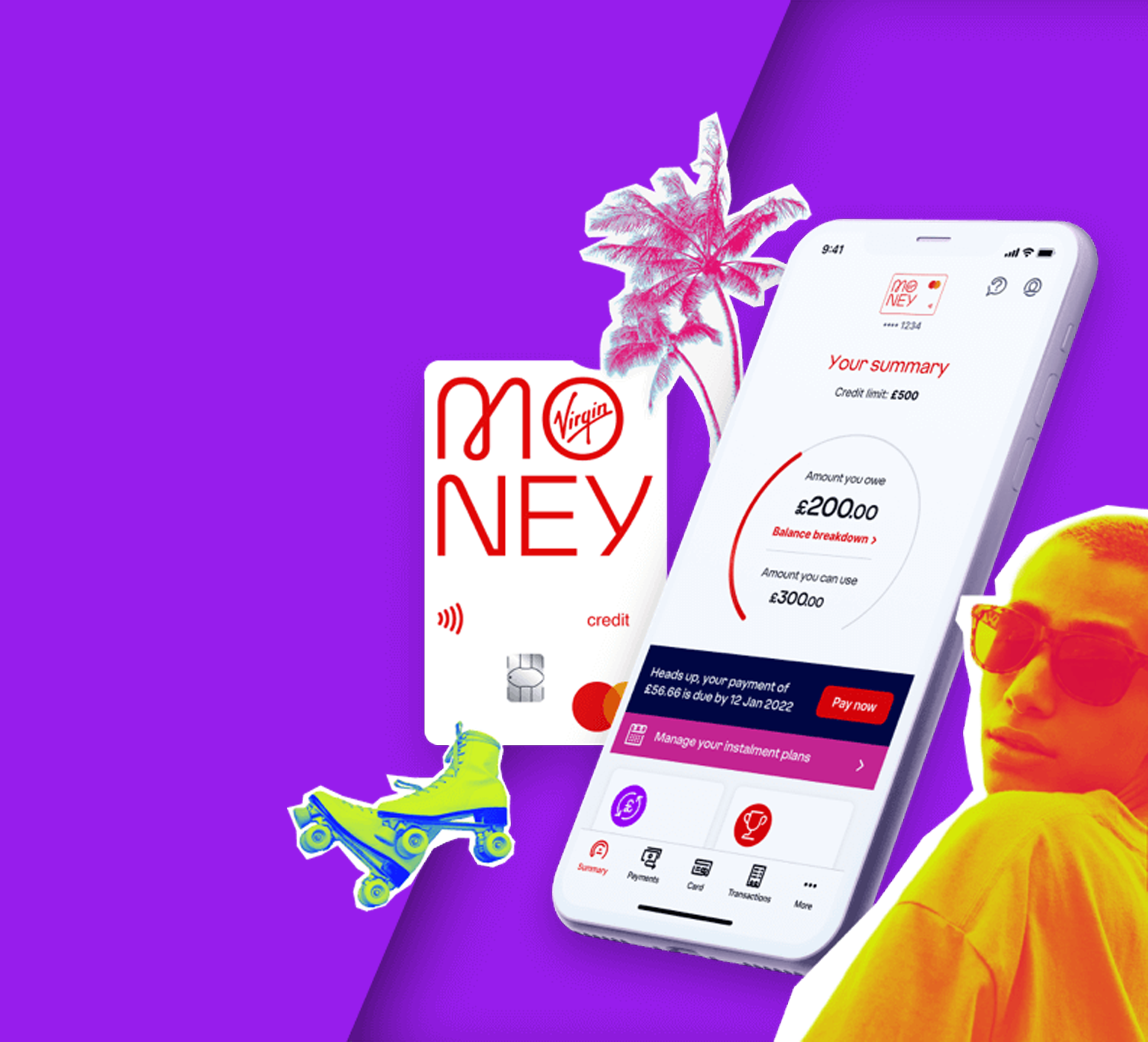

Customers will be able to view and manage their Slyce activity on the Virgin Money Credit Card app – which is packed full of handy features including reminders and alerts to keep payments on track, and a simple view to show exactly what is going out each month.

Unlike some other buy now, pay later providers, Slyce is fully regulated. This means it will have a range of controls, protections and safeguards in place. Virgin Money will also carry out credit and affordability checks before customers can start spending, to ensure that the product is right for them.

Created in partnership with Mastercard and TSYS, a global payments company, Slyce has been designed and built with Gen Z in mind. Customers will be able to see their credit score in the app and watch it grow – as well as learn more about how to boost it further. This is expected to be particularly helpful for Gen Z who are often new to credit and seeking to build their credit score for the future.

Want to know more about Slyce? Join the waiting list now. Anyone who joins the Virgin Money Slyce waiting list will be automatically entered into a prize draw to win one of five lots of 150,000 Virgin Points – that’s enough for a trip to Miami – as well as £2,000 spending money.

Miami not your style? There are loads of ways to spend Virgin Points with Virgin Red – sign up now and find out more.